FAQ — Quick Answers

What is the total number of physicians in the USA?

As of 2026, the United States has approximately 1.1 million licensed physicians, including both MDs and DOs across all specialties. This figure reflects the actively practicing workforce contributing to patient care nationwide.

How many actively practicing physicians are there?

Around 950,000 physicians are actively practicing in the U.S. in 2026. These are licensed doctors seeing patients regularly in hospitals, clinics, and private practices, excluding those retired, inactive, or in non-clinical roles.

What defines an active physician?

An active physician is licensed, board-certified or board-eligible, and currently seeing patients in a clinical setting. This includes primary care, specialty care, and surgical practitioners, but excludes administrative-only roles or retired doctors.

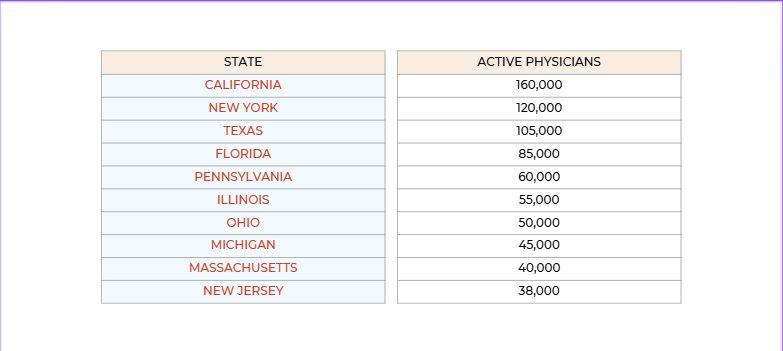

Which states have the most physicians in 2026?

The states with the largest physician workforce in 2026 include:

- California – ~160,000 active physicians

- New York – ~120,000 active physicians

- Texas – ~105,000 active physicians

- Florida – ~85,000 active physicians

- Pennsylvania – ~60,000 active physician

Which states have the fewest physicians per capita?

Physician density is lowest in rural and less populated states. In 2026, Wyoming, Alaska, North Dakota, and Montana report fewer than 200 physicians per 100,000 residents, highlighting regional shortages and access challenges.

How are physician numbers expected to change in the coming years?

Projections indicate steady growth in specialty care physicians but potential shortages in primary care due to retirements and regional imbalances. Population growth and aging demographics will continue to drive demand, particularly in underserved rural and suburban areas.

Total Physicians in the US -Overview

As of 2026, the United States is home to approximately 1.1 million licensed physicians, with around 950,000 actively practicing across hospitals, clinics, and private practices. These numbers include both MDs (Doctors of Medicine) and DOs (Doctors of Osteopathic Medicine) and cover all medical specialties.

Active vs. Licensed Physicians

Licensed Physicians: All doctors who hold a valid U.S. medical license, regardless of whether they are currently seeing patients. This includes physicians in administrative, research, or academic roles.

Active Physicians: Subset of licensed doctors who are currently providing clinical care to patients on a regular basis. This distinction is critical for workforce planning, resource allocation, and healthcare access analysis.

Sources & Methodology

The data presented here is based on American Medical Association (AMA) 2026 Physician Masterfile, supplemented by state medical board reports and specialty society registries. Methodology includes:

- Cross-referencing state licensure databases to verify active status.

- Classifying physicians by specialty and practice type.

- Excluding retired, inactive, or administrative-only roles.

This ensures that the figures reflect the practical, patient-facing physician workforce in the U.S., providing a reliable foundation for policymakers, healthcare organizations, and businesses looking to understand the physician market in 2026.

Total Physicians by State (2026)

Understanding the geographic distribution of physicians is critical for healthcare planning, policy decisions, and B2B marketing efforts targeting medical professionals. In 2026, physician numbers vary widely across states, influenced by population size, healthcare infrastructure, and urban-rural distribution.

Key Insights

- High-Concentration States: California, New York, and Texas lead in total numbers, reflecting large populations and major healthcare hubs.

- Density Matters: Massachusetts and New York have high physician-to-population ratios, indicating more concentrated access in urban regions.

- Low-Density States: Wyoming, Alaska, and Montana report fewer than 200 physicians per 100,000 residents, highlighting rural shortages.

- B2B Marketing Implications: States with higher physician density, like New York, Massachusetts, and California, are prime targets for outreach campaigns involving medical devices, healthcare software, and specialty products. Low-density states require more focused, relationship-based approaches.

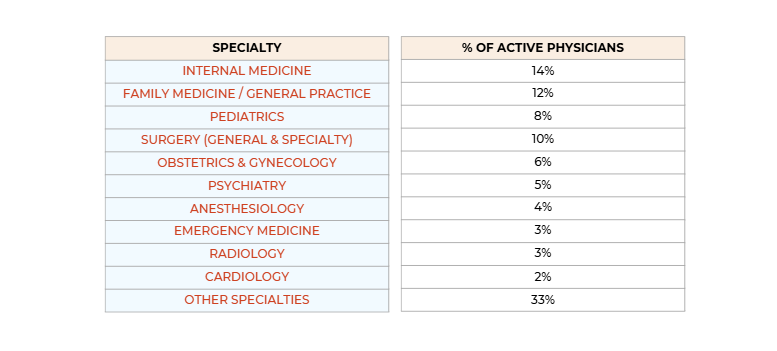

Physicians by Specialty (MD vs DO & Common Specialties)

Understanding the distribution of physicians by degree type and specialty is essential for healthcare planning, policy analysis, and targeted B2B marketing campaigns. In 2026, the U.S. physician workforce continues to evolve, with shifts in specialty demand, DO growth, and primary care shortages shaping the landscape.

Key Trends in 2026

- Primary Care Shortages: Family medicine and general practice face ongoing shortages due to retirements and slower growth in residency slots.

- Specialty Growth: High-demand specialties like cardiology, psychiatry, and anesthesiology continue to expand, driven by population aging and technological adoption.

- DO Influence: DOs increasingly fill gaps in primary care, rural hospitals, and underserved regions, making them a critical segment for healthcare marketers.

- Implications for B2B Marketing: Targeted campaigns should consider specialty distribution. For example, pharma products or medical devices for cardiology should focus on states with high cardiologist density, while primary care outreach benefits from DO-targeted messaging in rural or underserved markets.

Key Trends in the US Physician Workforce (2026)

Understanding workforce trends is essential for healthcare marketers who want to target the right physician segments, plan outreach campaigns, and optimize ROI. In 2026, several key shifts are shaping the physician landscape in the U.S.:

Aging Workforce & Retirement Trends

- Nearly 35% of active physicians are over 55, signaling an imminent wave of retirements in the next 5–10 years.

- Primary care and general surgery are the most affected, creating gaps that healthcare companies can anticipate for targeted services and solutions.

- B2B Insight: Retiring physicians often create opportunities for digital health tools, EMR solutions, and practice acquisition services.

Physician Shortages & Future Projections

- The U.S. continues to face a shortage of 20,000–30,000 primary care physicians by 2026, particularly in rural and underserved regions.

- Specialty shortages are growing in psychiatry, anesthesiology, and geriatrics.

- B2B Insight: Shortage areas are prime markets for pharmaceutical, diagnostic, and telehealth solutions, as organizations look to support remaining clinicians.

Geographic Distribution Inequality

- Urban centers (New York, California, Massachusetts) have high physician density, while states like Wyoming, Alaska, and Montana report fewer than 200 physicians per 100k residents.

- B2B Insight: Marketing campaigns should focus on high-density urban states for scale, while rural states require personalized, relationship-driven outreach.

Growth of DO vs MD & Specialty Shifts

- DO physicians continue to grow in number, especially in family medicine and primary care.

- Certain specialties such as cardiology, oncology, and radiology are seeing rapid growth due to aging populations and advanced technology adoption.

- B2B Insight: Companies can segment campaigns by degree type and specialty to reach primary care influencers versus specialty decision-makers.

Impact of Technology & AI on Physician Roles

- Adoption of AI-driven diagnostics, telehealth, and electronic health records is reshaping physician workflows.

- Physicians who embrace technology are more receptive to digital health solutions, SaaS platforms, and AI-powered tools.

- B2B Insight: Targeting early technology adopters provides higher ROI for marketing campaigns in software, diagnostics, and medical devices.

Summary for B2B Healthcare Marketers:

- Focus on high-density states and specialty-specific clusters.

- Target DOs in primary care for rural and underserved markets.

- Position digital health, AI, and efficiency-enhancing solutions for physicians impacted by technology adoption.

- Use retirement trends and shortage projections to anticipate demand for medical products, services, and CRM-targeted campaigns.

Why Physician Data Matters (High-Level Insights)

Accurate physician data is a cornerstone for strategic decision-making in healthcare and B2B marketing. Knowing who the active physicians are, their specialties, locations, and practice settings allows organizations to:

Business Insights

- Identify high-value targets for medical devices, pharmaceuticals, diagnostic tools, and healthcare software.

- Segment campaigns by specialty, degree type (MD vs DO), and geography to maximize engagement and ROI.

- Monitor trends such as retirement waves, physician shortages, and urban-rural distribution to anticipate demand.

Research & Planning

- Evaluate market penetration opportunities and prioritize regions with high physician density.

- Inform product launches, educational programs, and outreach initiatives based on specialty-specific needs.

- Support data-driven decision-making for both marketing and healthcare service expansion.

In short, high-quality physician data enables precision targeting, smarter planning, and more effective outreach, making it an essential resource for B2B marketers aiming to reach the right healthcare professionals at the right time.

How to Use Physician Data for Marketing?

Physician data is a powerful tool for B2B healthcare marketers when used strategically. Key approaches include:

- Segmented Targeting: Organize campaigns by specialty, practice type, geographic location, or degree (MD vs DO) to reach the most relevant physicians.

- Personalized Outreach: Tailor messaging based on physician interests, patient volume, or technology adoption to increase engagement.

- Regional Campaign Planning: Focus on high-density states for scale, and low-density/rural regions for relationship-driven outreach.

- Product & Service Alignment: Match your offerings to specialties experiencing shortages or growth, such as primary care, cardiology, or telehealth-focused practices.

Using these strategies ensures higher ROI, improved conversion rates, and efficient resource allocation for healthcare marketing campaigns.

Physician Email Lists — Value & Uses

Physician email lists provide verified, up-to-date contact information, enabling marketers to:

- Reach actively practicing physicians across all specialties and states.

- Conduct email marketing, multichannel campaigns, and event invitations with precision.

- Segment lists by specialty, state, practice size, or technology adoption, ensuring campaigns are relevant.

- Support research, market intelligence, and outreach analytics, optimizing decision-making.

For marketers seeking ready-to-use physician contact data, comprehensive physician email lists are available at the end of this guide. These lists help maximize campaign effectiveness while reducing time spent on data collection and verification.

MedicoLeads Physician Email List

For healthcare marketers looking to reach the right physicians efficiently, the MedicoLeads Physician Email List offers verified, up-to-date contact data for MDs and DOs across all specialties and U.S. states.

Key Benefits

- Accurate & Verified Data: Every physician record is validated to ensure emails, phone numbers, and practice details are current.

- Segmented Targeting: Filter by specialty, state, degree type, and practice setting to focus on the most relevant audience.

- Enhanced Campaign Performance: Use the list for email marketing, multichannel outreach, webinars, and market research.

- Time & Resource Savings: Skip the manual data collection; focus on high-ROI engagement with active healthcare professionals.

Whether you are promoting medical devices, pharmaceuticals, digital health solutions, or practice services, the MedicoLeads Physician Email List ensures your campaigns reach verified, decision-making physicians at scale.

Access a verified physician email list to target MDs & DOs across specialties and states. Boost B2B healthcare campaigns with accurate, high-quality contacts.

Get the List NowSummary & Key Takeaways

- Total Physicians in 2026: ~1.1 million licensed physicians, with ~950,000 actively practicing across MD and DO degrees.

- State Distribution: High-density states like California, New York, and Texas lead in total numbers, while rural states like Wyoming, Alaska, and Montana have the lowest physician-per-capita ratios.

- Specialty Insights: Primary care faces shortages, DOs increasingly serve underserved areas, and specialties like cardiology, psychiatry, and anesthesiology are growing.

- Workforce Trends: Aging physicians, retirements, and geographic imbalances are reshaping the physician landscape.

- Marketing Implications: B2B marketers should leverage physician data for segmented outreach, personalized campaigns, and high-ROI targeting, focusing on specialty, location, and degree type.

- Physician Data Value: Verified, up-to-date contact lists streamline campaigns, reduce manual effort, and improve engagement with healthcare decision-makers.

Additional FAQs (Expanded)

How can I use physician data for marketing in 2026?

Segment by specialty, degree, state, or practice type to personalize campaigns and maximize ROI. Focus on high-density and high-demand regions for efficiency.

What specialties are most underserved and offer B2B opportunities?

Primary care, psychiatry, geriatrics, and rural general practice experience shortages, making them ideal for product adoption, telehealth, and service outreach.

Are DO physicians important for healthcare marketing campaigns?

Yes. DOs represent ~16% of active physicians, mainly in primary care and rural areas, and are crucial targets for campaigns in underserved regions.

How often is physician data updated?

Reputable sources like AMA and MedicoLeads refresh physician contact data annually or more frequently, ensuring accuracy for campaigns and research.

Can I segment physician email lists by state and specialty?

Yes. Segmentation allows precise targeting by specialty, state, degree type, and practice setting, improving campaign relevance and engagement.

What trends should B2B marketers watch in 2026?

Focus on retirement waves, primary care shortages, specialty growth, and technology adoption among physicians for better-targeted marketing strategies.